Coop Overview

Years in Service

AIM-MPC Branches

Members as of Mar 10, 2026

Website Visitors

AIM-MPC History

AIM-MPC Building (Main Branch)

The Avon Independent Managers’ Multi-Purpose Cooperative or AIM-MPC was registered with the Cooperative Development Authority (CDA) on Feb. 28, 1992. It was organized primarily to promote the habit of thrift with an in house where they can save, make available loans for productive and providential purposes and provide members with continuous education on how to benefit from joining the cooperative. Its membership was then exclusively for four branches consisting about two hundred (200) supervisors.

It was registered with fifteen cooperators with initial paid up capital of THIRTY SEVEN THOUSAND FIVE HUNDRED ONLY (P37,500.00). It was founded in 1989 upon the direction of Former Avon General Manager Jose Mari Franco with Franchise Manager Tomasa M. Montemayor as the founding Chairperson.

Avon Independent Dealers’ Credit Cooperative Incorporated (AID-CCI) was the original name changed to Avon Independent Managers’ Credit Cooperative or AIM-CC in 1999 and finally changed to AIM-MPC in 2003. The first provincial branches to join were Dagupan and Cabanatuan in 1997 and all Avon provincial branches enlisted in the Cooperative in 2005.

Testimonials

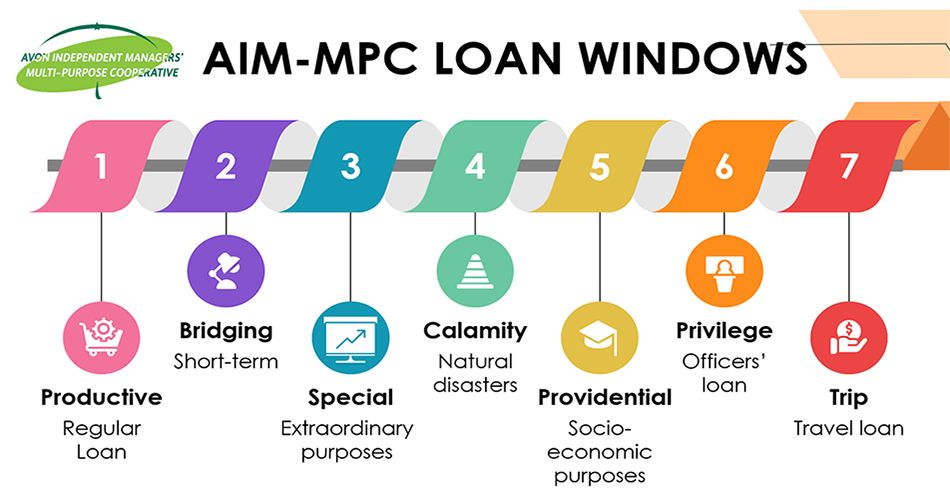

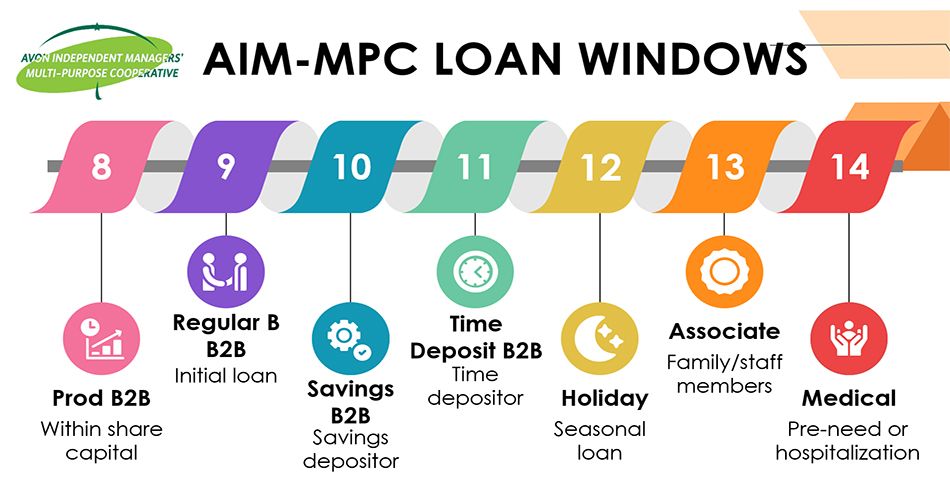

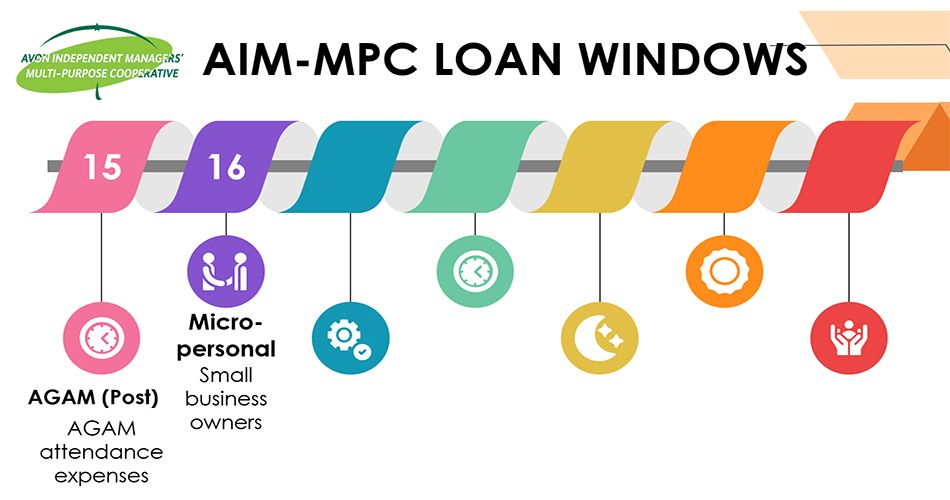

Loan Portfolio

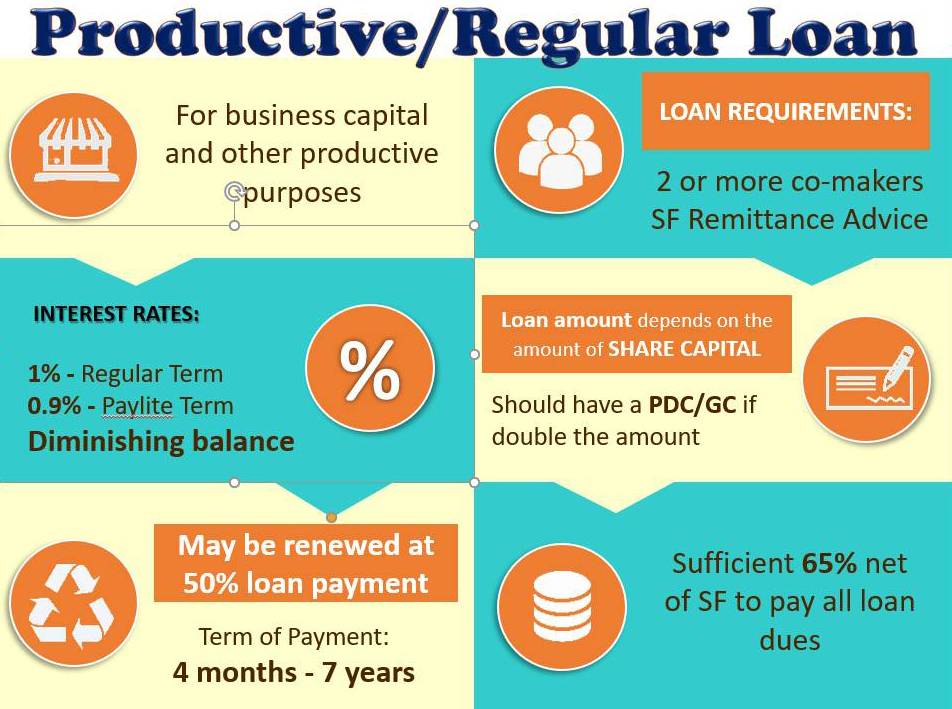

Productive/Regular Loan

| Loan Amount | Regular Term | Paylite | |

| From | To | Months | |

| 1,000.00 | 4,500.00 | 6 months | 8 months |

| 5,000.00 | 10,000.00 | 8 months | 9-12 months |

| 11,000.00 | 24,000.00 | 8 months | 13-18 months |

| 25,000.00 | 25,000.00 | 12 months | 13-18 months |

| 26,000.00 | 49,000.00 | 12 months | 19-14 months |

| 50,000.00 | 50,000.00 | 18 months | 19-14 months |

| 51,000.00 | 74,000.00 | 18 months | 25-30 months |

| 75,000.00 | 99,000.00 | 24 months | 25-30 months |

| 100,000.00 | 100,000.00 | 30 months | 25-30 months |

| 101,000.00 | 200,000.00 | 30 months | 31-36 months |

| 201,000.00 | 299,000.00 | 30 months | 37-42 months |

| 300,000.00 | 300,000.00 | 36 months | 37-42 months |

| 301,000.00 | 400,000.00 | 36 months | 43-48 months |

| 401,000.00 | 499,000.00 | 36 months | 49-60 months |

| 500,000.00 | 500,000.00 | 42 months | 49-60 months |

| 501,000.00 | 999,000.00 | 42 months | 61-72 months |

| 1,000,000.00 | 1,000,000.00 | 48 months | 61-72 months |

| 1,001,000.00 | 1,999,000.00 | 48 months | 73-84 months |

| 2,000,000.00 | 2,000,000.00 | 54 months | 73-84 months |

| 2,001,000.00 | 2,999,000.00 | 54 months | 85-96 months |

| 3,000,000.00 | 3,000,000.00 | 60 months | 85-96 months |

| 3,001,000.00 | 3,999,000.00 | 60 months | 97-108 months |

| 4,000,000.00 | 4,000,000.00 | 66 months | 97-108 months |

| 4,001,000.00 | 6,000,000.00 | 66 months | 109-120 months |

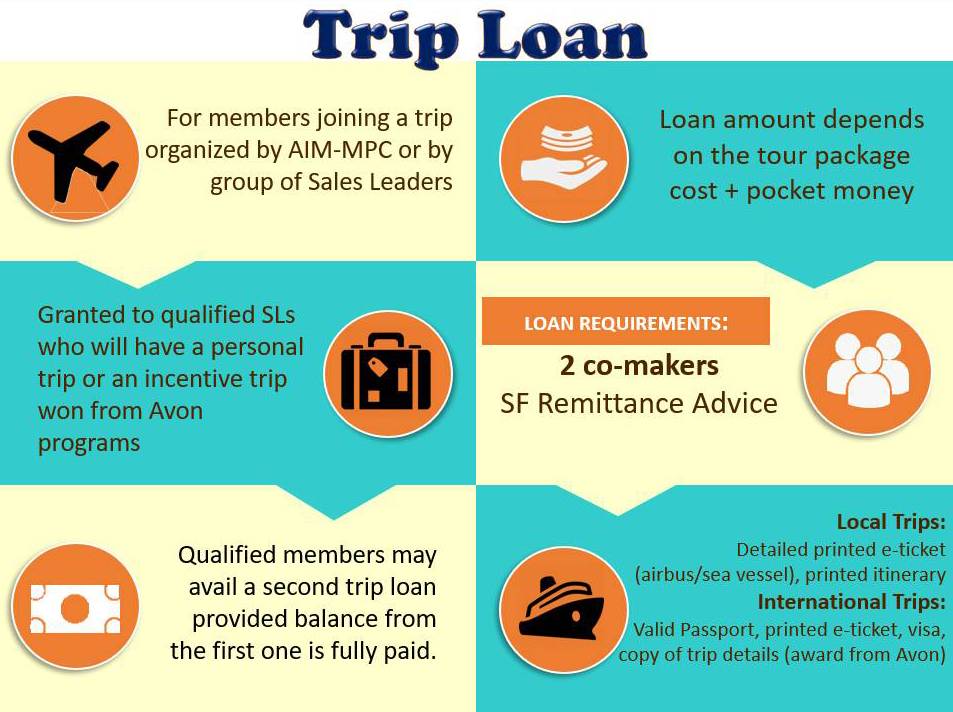

Trip Loan

Guidelines:

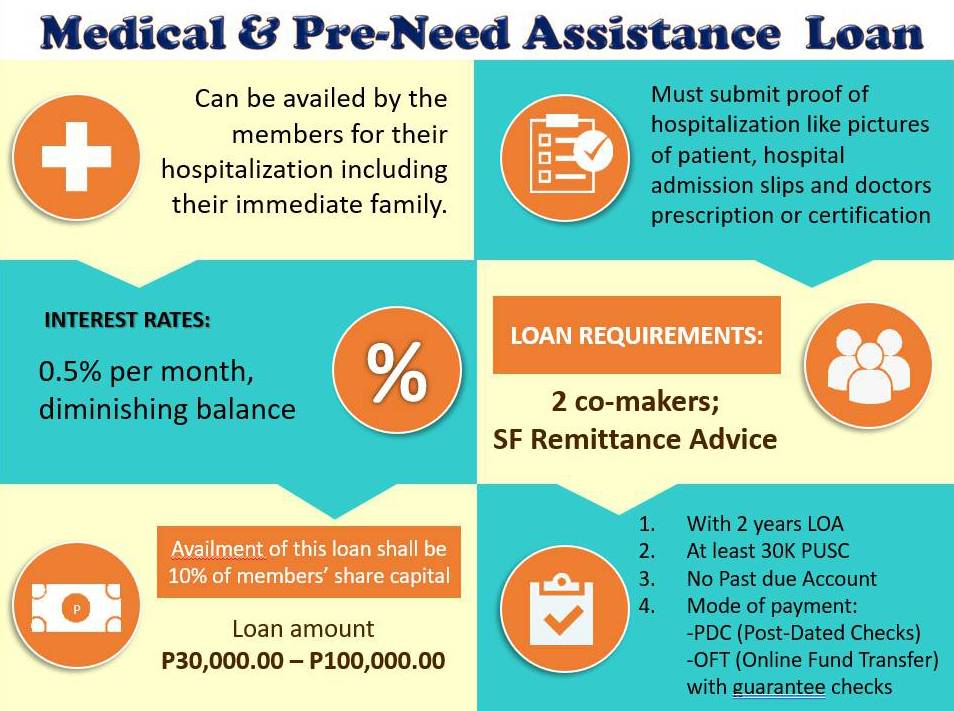

Medical & Pre-Need Assistance Loan

To help our members in time of need. Limited to the following:

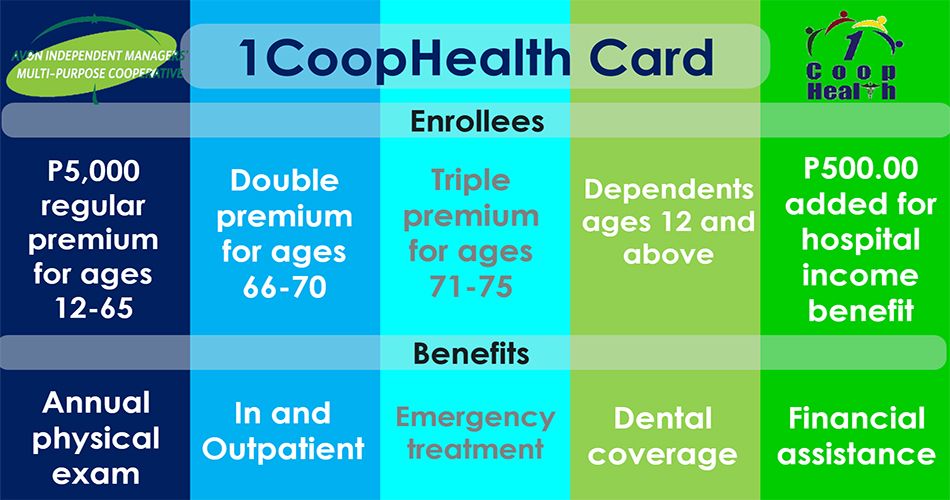

1COOPHEALTH’s goal is to provide cooperative members with:

Who are the enrollees?:

Ages and Premium

Dependents

Loan Terms in Years

| P1,000 to P50,000 | P51,000 to P100,000 | P101,000 to P500,000 | P501,000 to P1million | P1million to P6million |

| REGULAR | ||||

| 6 months to 1.5 years | 1.5 to 2.5 years | 2.5 to 3.5 years | 3.5 to 4 years | 4 to 5.5 years |

| PAY LITE | ||||

| 6 months to 2 years | 2 to 3 years | 3 to 5 years | 3.5 to 6 years | 7 to 10 years |

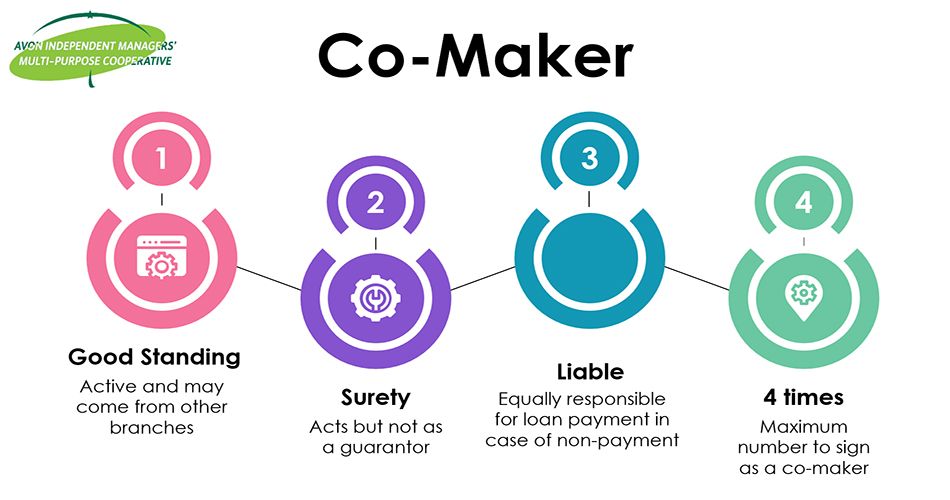

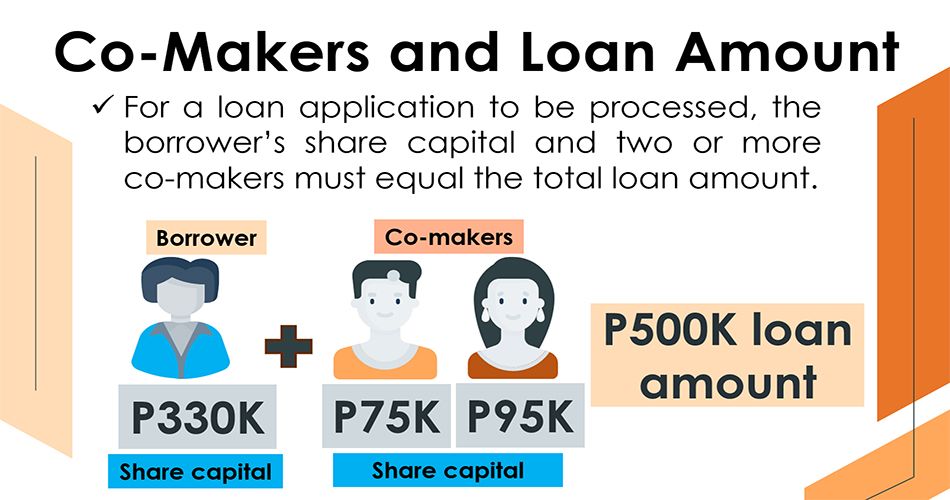

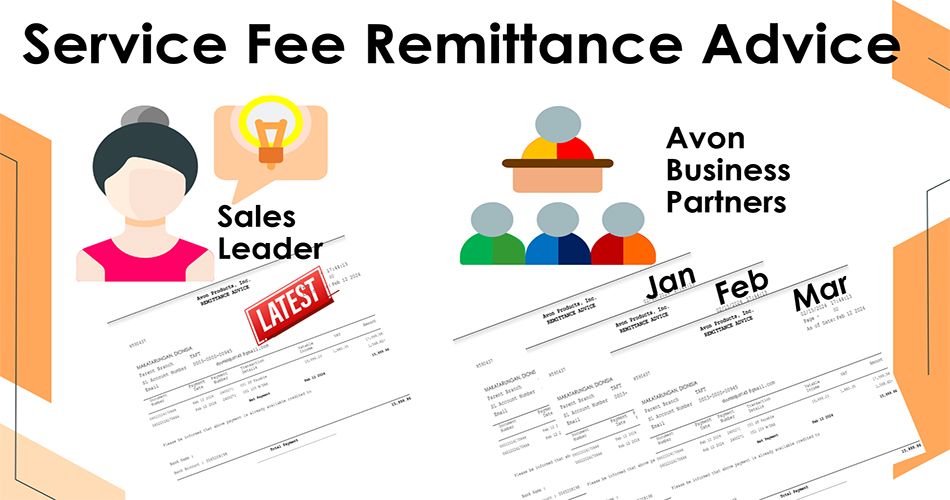

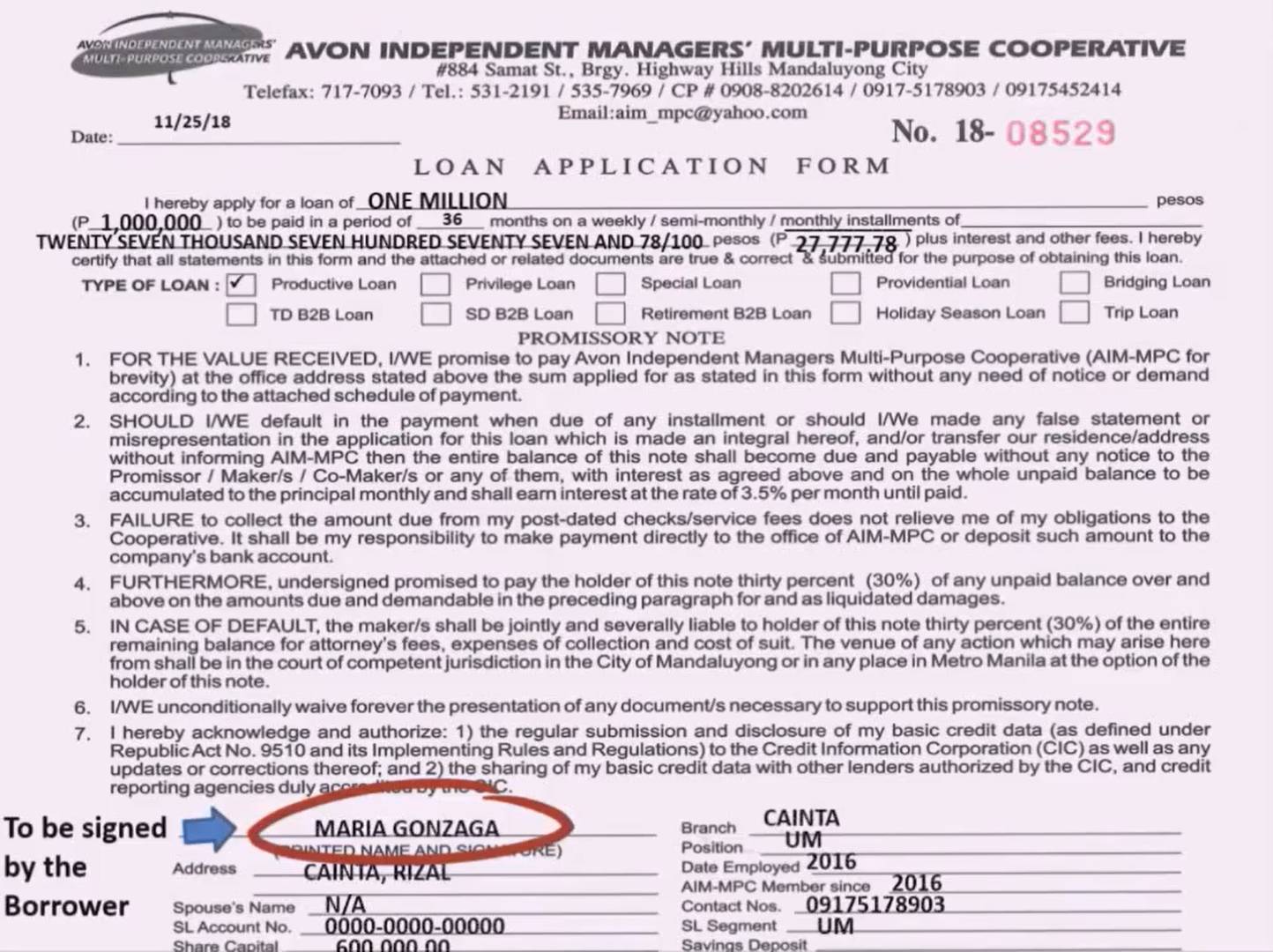

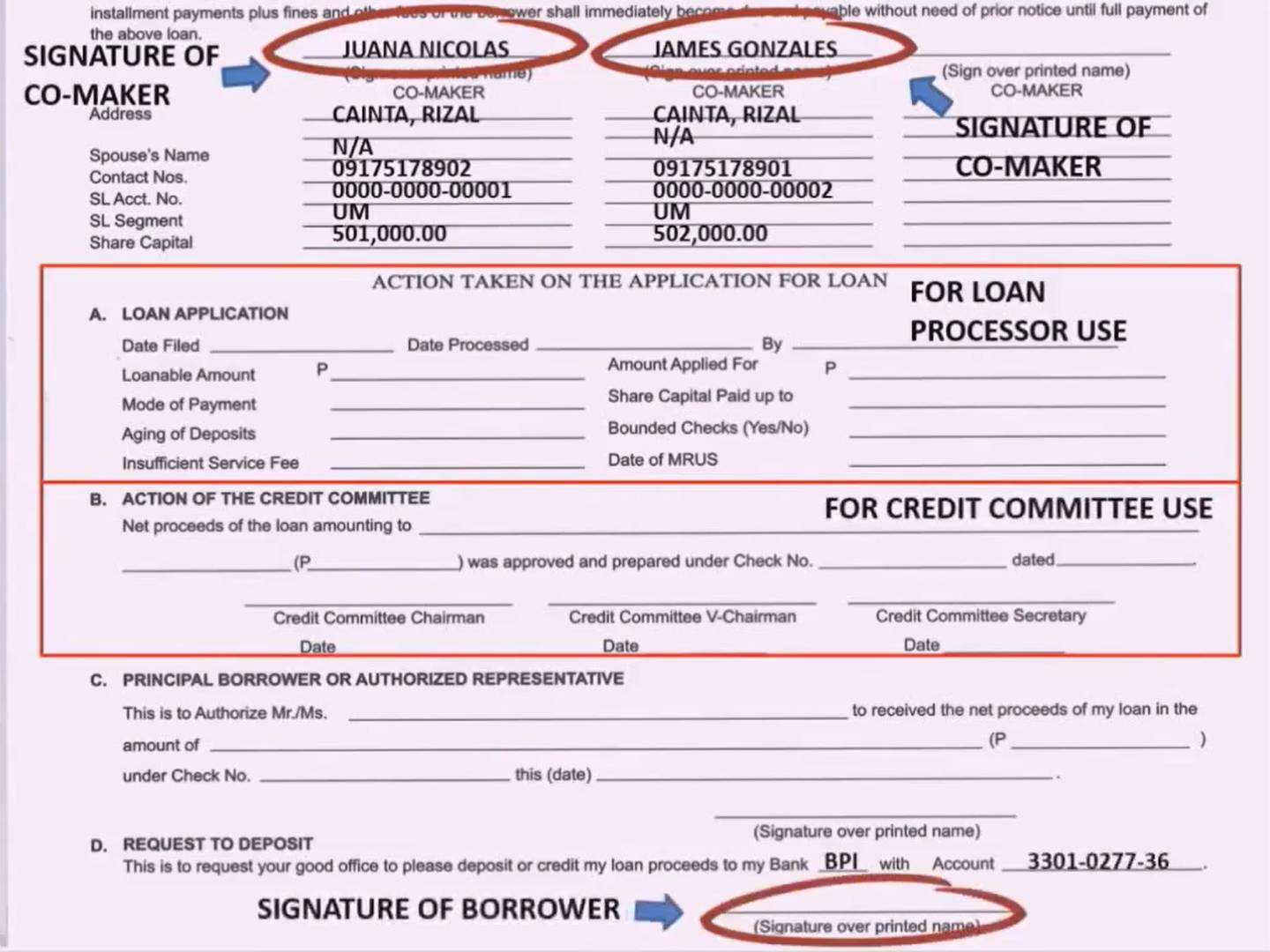

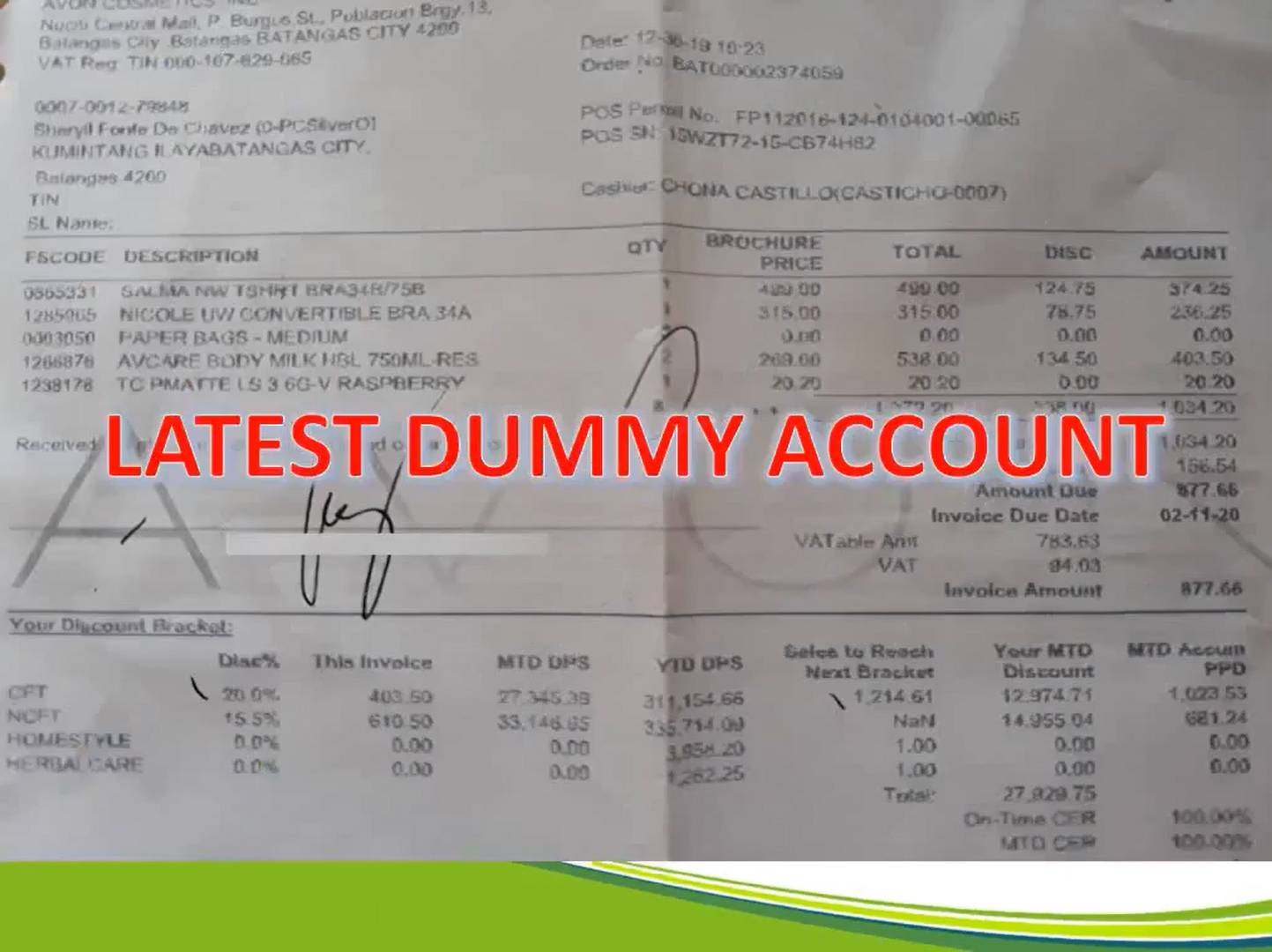

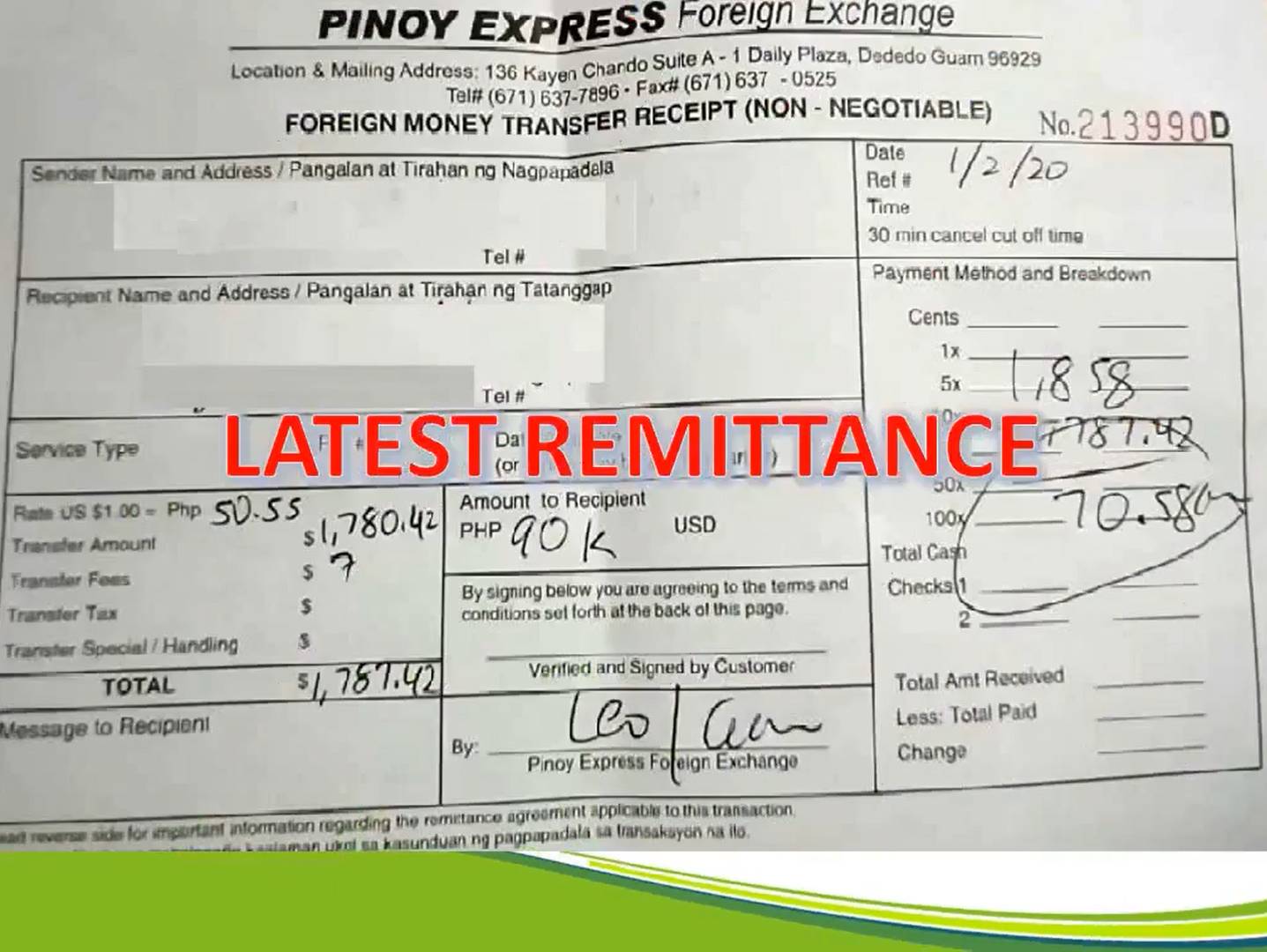

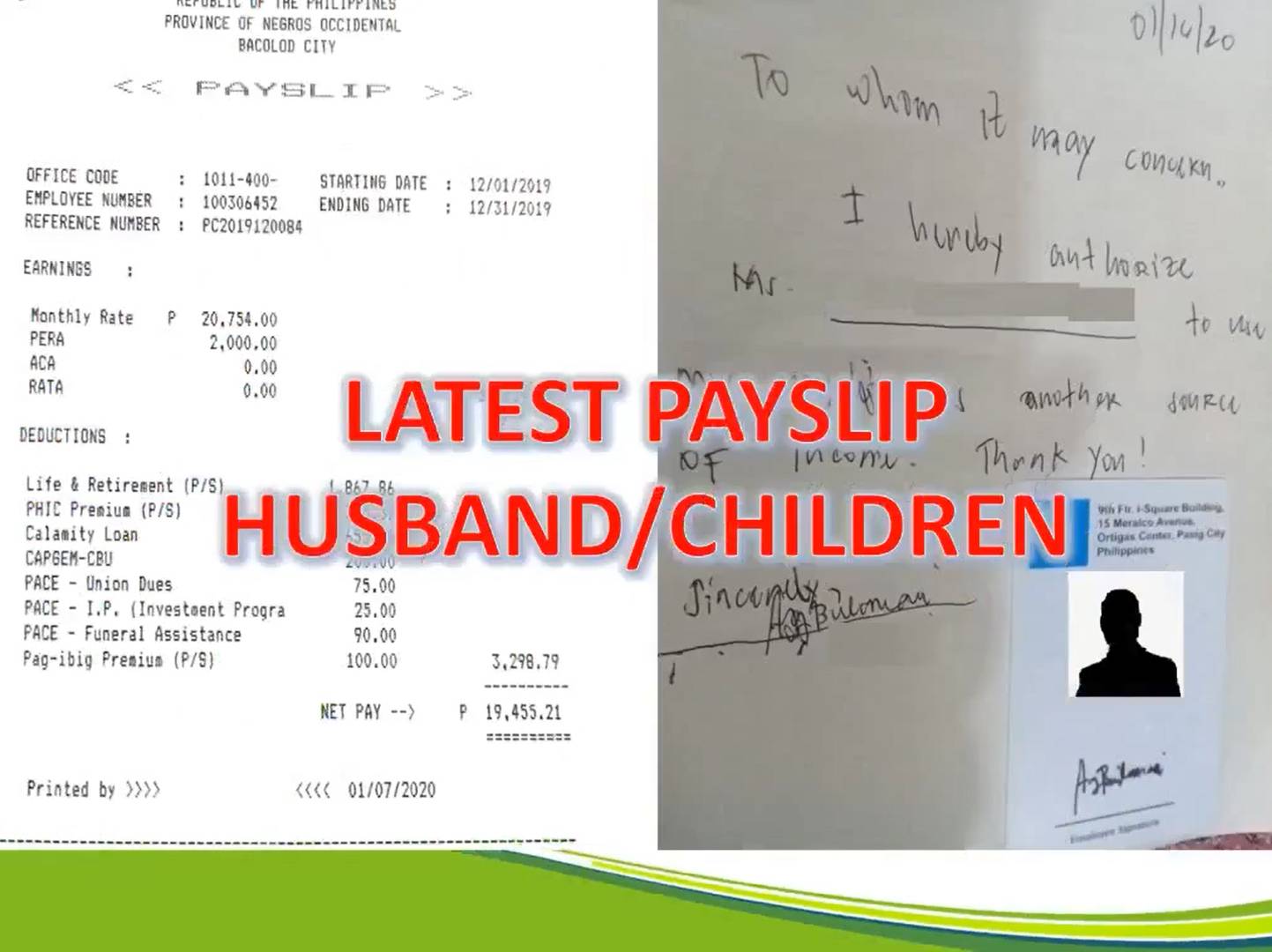

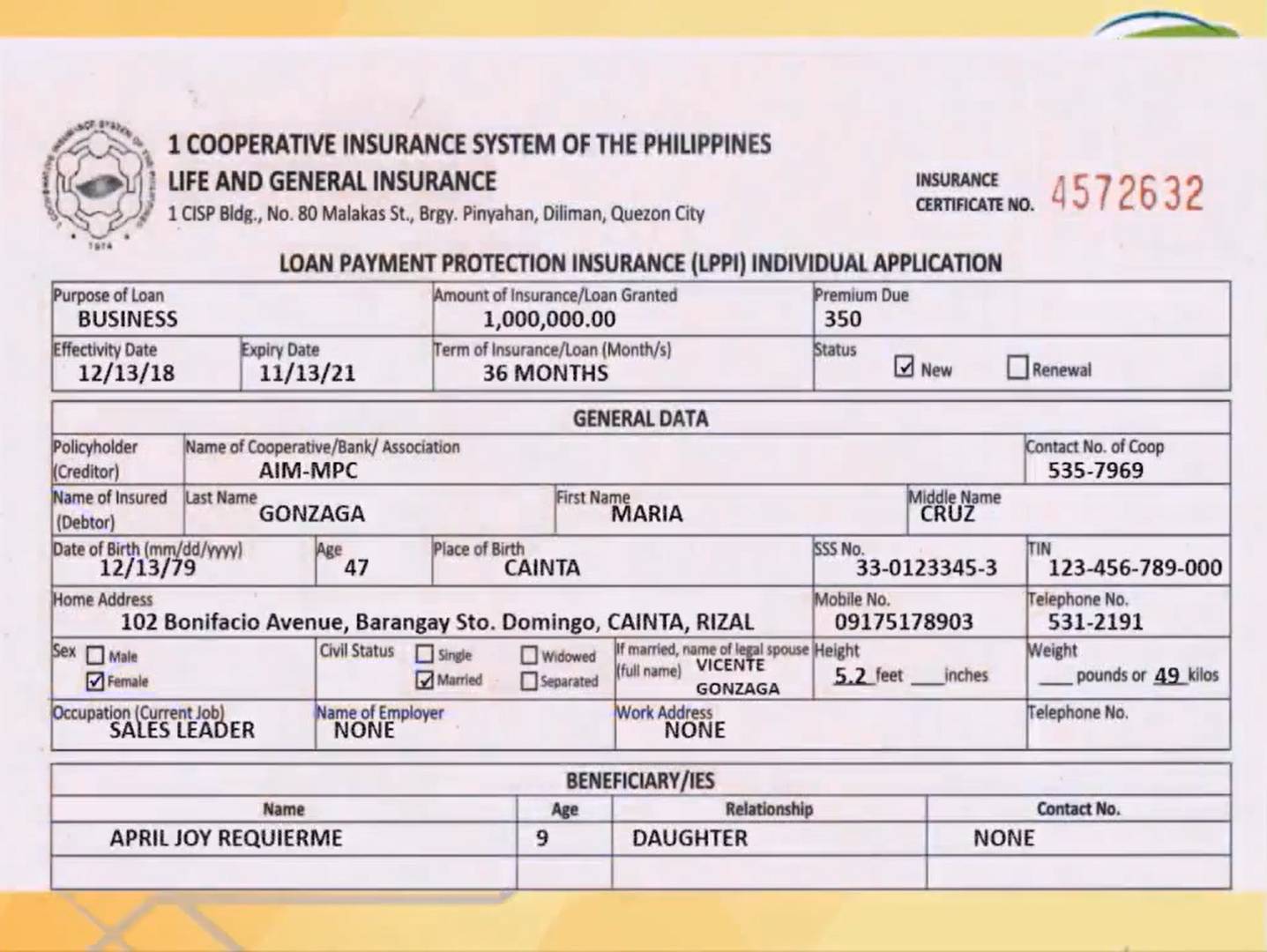

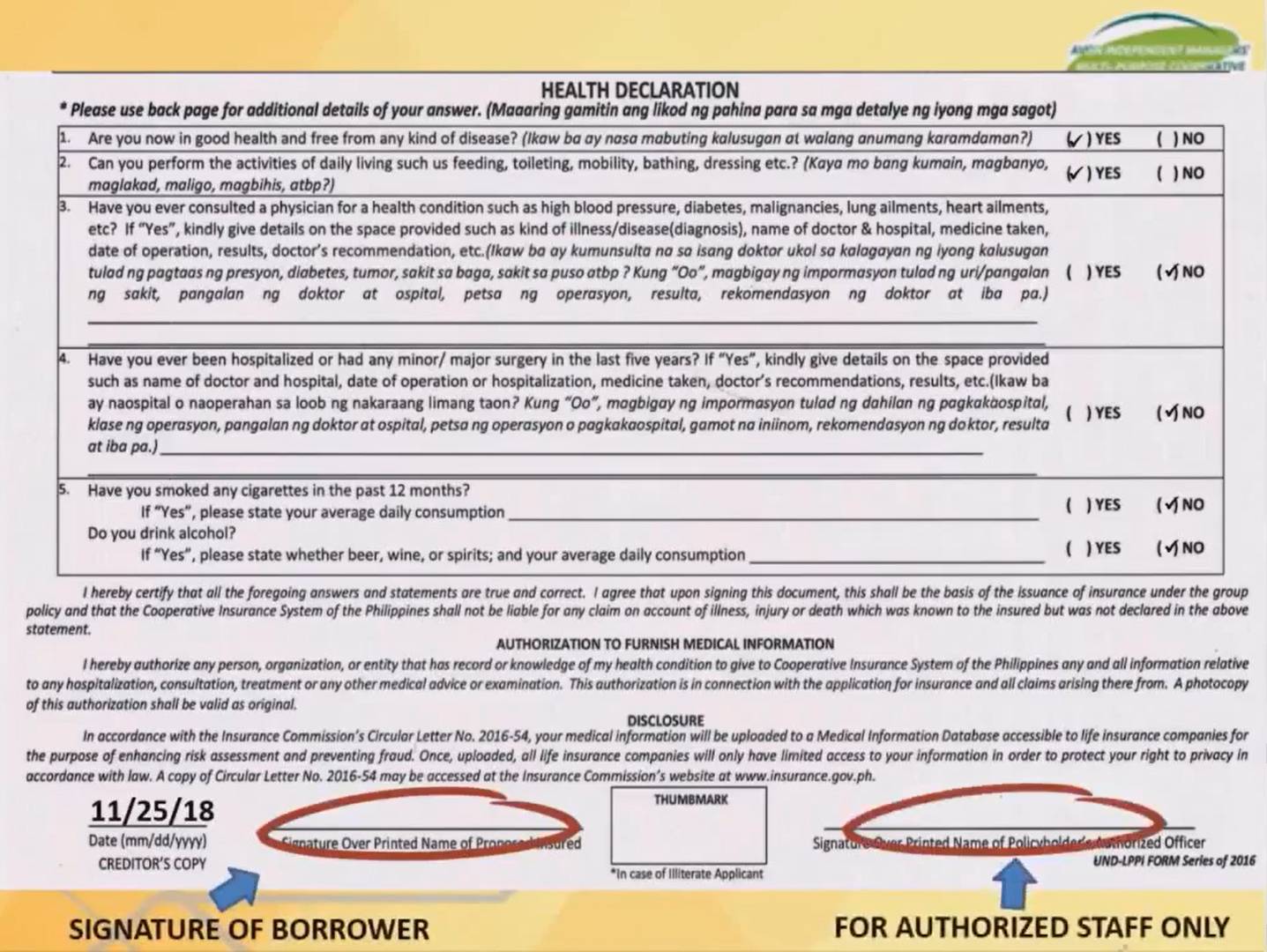

Loan Requirements

4. Other Sources of income (OSI), if required

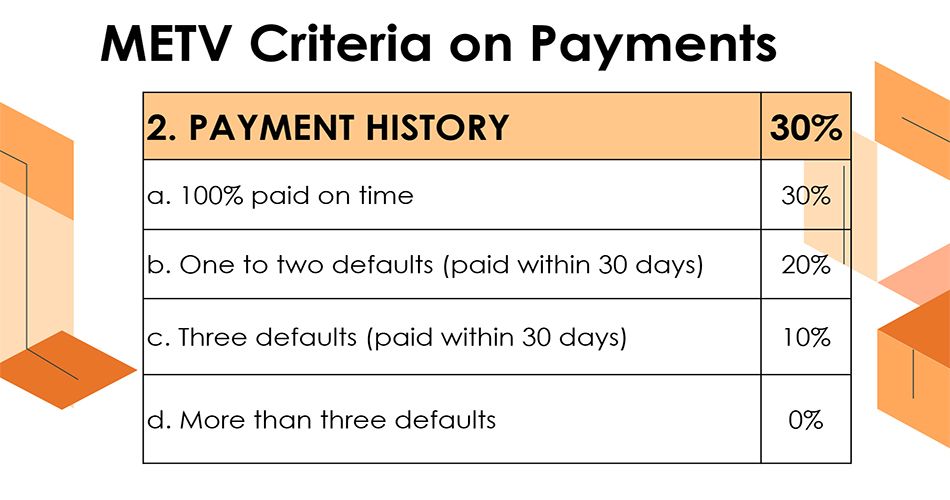

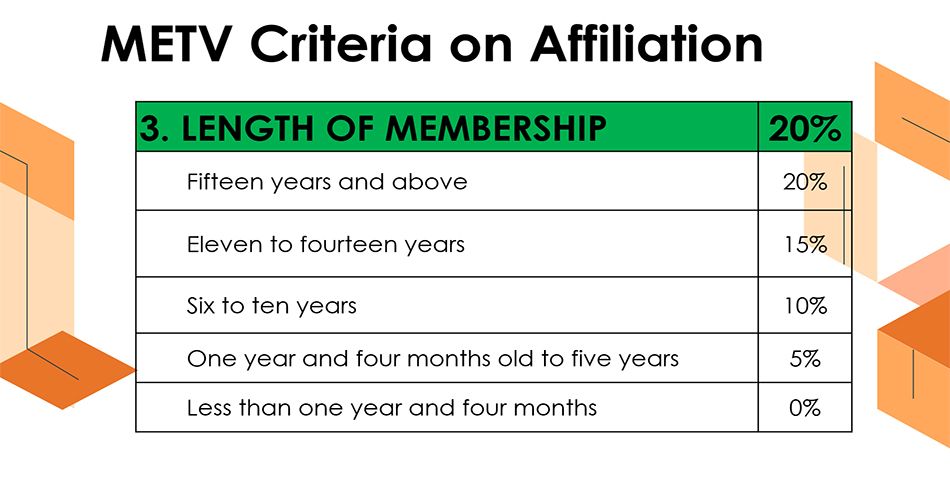

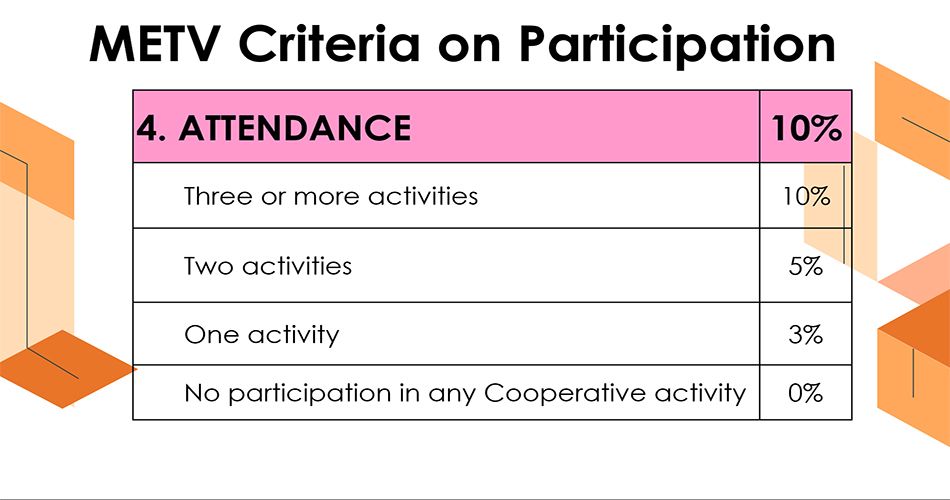

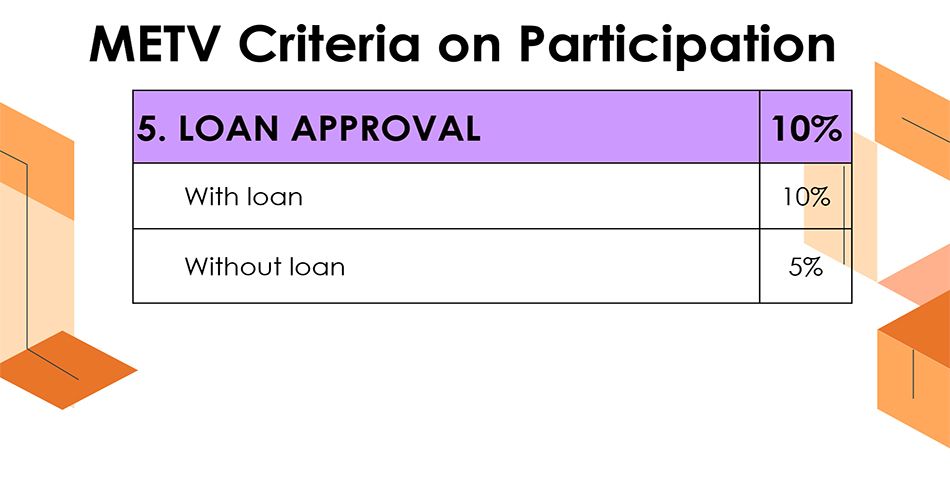

New Credit Classification of Members

| Particulars | Diamond | Gold | Silver | Bronze |

| Length of Membership | 10 years up | 8-9 years | 6-7 years | 5 years |

| Share Capital | 1,000,001.00 & above | 700,001 to 1M | 500,001.00 to 700K | 300K to 500K |

| Loan Amount | 6M | 3.3M | 2.240M | 1.5M |

| Max Amount (All Windows) | x 3.5 of SC | x 3.3 of SC | x 3.2 of SC | x 3 of SC |

| Reinstatement | 1 year | 1 year | 2 years | 2 years |

1. Maximum loan amount per individual is increased to 6 million, previously 4 million.

2. Maximum term from 72 months in regular terms to 84 months in paylite terms.

3. Members with insufficient service fees are limited to only x2 and x2.5 in all loan windows.

4. Seniors and members with existing health conditions under LPF may avail x2.5 in all loan windows.

5. Supersedes resolutions entitled Guidelines on x2 Productive Loan and Platinum Card for Incorporators and Elite members.

Loan Retention & Insurances

Loan Retention

| Paid up Share Capital | Retention Rate |

| 500k and below | 1% to share capital 1% to savings account |

| 501K and above | 2% to savings account |

Loan Insurances

Provides protection and security to both MEMBER and AIM-MPC. The insurance pays the loan balance in case a member with a loan passes away

|

|

1. Maximum insurance coverage up to ten million.

2. Age coverage is 18 to 65 years old.

3. Optional insurance.

4. Has a bonus benefit covering life, accident and total permanent disability.

5. Premium rate is P 0.56/P1,000.00

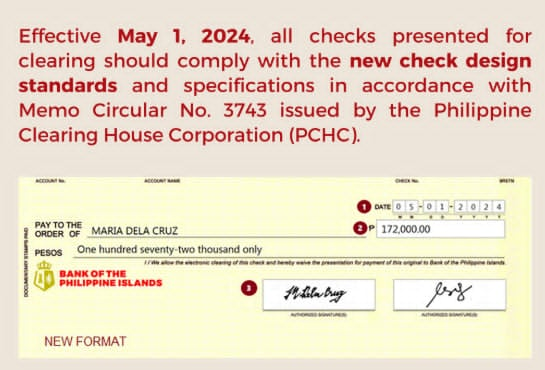

LOAN PAYMENT PROTECTION INSURANCE (LPPI)

LPPI Premium

Formula: Loan amount / 1,000 x loan term x P 0.50

Loan amount: P50,000.00

Loan Term: 18 months

LPPI Premium: P450.00

Example:

| P 50,000 / P 1,000 | = P 50.00 |

| P 50.00 x 18 months | = P 900 |

| P 900.00 x P 0.50 | = P 450 (premium) |

Loan Protection Fund (LPF)

In-house loan insurance coverage for members who are:

| Age | 66-69 | 70-74 | 75-79 | 80-84 | 85 above |

| Loan Term (months) | LPF Rate | ||||

| 6 to 12 | 1.50% | 1.75% | 2.00% | 2.25% | 2.50% |

| 13 to 24 | 1.75% | 2.00% | 2.25% | 2.50% | 2.75% |

| 25 to 36 | 2.00% | 2.25% | 2.50% | 2.75% | 3.00% |

| 37 to 48 | 2.25% | 2.50% | 2.75% | 3.00% | 3.25% |

| 49 to 60 | 2.50% | 2.75% | 3.00% | 3.25% | 3.50% |

| 61 up | 2.75% | 3.00% | 3.25% | 3.50% | 3.75% |

LPF Premium Computation

Sample for a 67-year-old member availing a P300,000 loan payable in 60 months

Formula:

Loan amount x LPF rate = Premium

P300,000.00 x 2.50% = P7,500.00

Premium = P7,500.00 (per year)

Loan Renewal & Restructuring

Loan Renewal

This may be granted upon 50% payment of existing loan, except for Regular Member B and Associate Members’ Back-to-Back Loan.

Loan Restructuring

Reduced interests and penalties to as low as the following:

This program will:

Subject to a new insurance coverage, with total premiums added to the principal amount. Loan Restructuring shall apply only to one or more loans totaling P100,000.00 and above.

Past Due Accounts and Penalty

Past Due Accounts

Amortization not paid on due date and loan term.

Types of PDA:

Penalty Reduction Program

Penalty during the period is reduced to only 1%, if members opt to withdraw, a 1% penalty is applied without a discount. The 2% penalty reverts after this duration.

2% May 1, 2029 onwards

1% August 22, 2024 to April 30, 2028

Loan Penalty Condonation Program - Program duration April 2024 to April 2027

When members pay their loan balance, the principal amount plus interest without penalty is computed during the three-year program.

Loan Balance/Reversal

Members have the option to deduct their outstanding balances from the proceeds of their loan renewal.

All loans not claimed within a month shall be subject to cancellation or reversal charges, which is P5.00 for every P1,000.00 loan amount.

Unpaid amortizations deducted from loan renewal shall be due and demandable upon reversal of accounts. Should be paid in cash or via online fund transfer.

Legal Actions

Accounts not paid on time shall undergo the following process prior to the filing of legal actions within the five (5) working days grace period

1. The Accounting Assistant sends reminder through call or text

2. The General Manager will send spur collection letter

3. The GM sends demand letter signed by the co-operative’s legal counsel

4. If borrower fails to pay despite due notice, legal case shall be filed through the proper courts.

Twilight Program

| PARTICULARS | REQUIREMENTS | |

| New Member/Secondary | Old Damayan Member | |

| Membership Fee | 500.00 | exempted |

| Savings Deposit | 1,000.00 each | 1,000.00 |

| CLAIM TYPE | BENEFIT |

| Death | P50.00 x No. of Members |

| Total and Permanent Disability (TPD) | P25.00 x No. of Members |

| Death after TPD | P25.00 x No. of Members |

| MARRIED | SINGLE | UNMARRIED/ SEPARATED |

| Legal spouse/co-applicant | One of the parents | One of the children |

| One of the children | One of the siblings | One of the parents |

| One of the parents | One of the cousins | One of the siblings |

| One of the grandchildren | One of the cousins |

Guidelines

Additional Guidelines

Replenishment

* Member must send a corresponding bank deposit slip through messenger or AIM-MPC’s FB group page, with name written on the slip

ADDITIONAL GUIDELINES ON CLAIMS

TP List of Illnesses

Major health conditions excluded for TP enrolment

| 1. Heart Attack | 20. Stroke |

| 2. Cancer | 21. Kidney Failure |

| 3. Dissecting Aortic Aneurysm | 22. End Stage Lung Disease |

| 4. Progressive Muscular Atrophy | 23. Major Burns |

| 5. Multilple Sclerosis | 24. Paralysis |

| 6. One Eye or Total Blindness | 25. Loss of Limbs |

| 7. Aplastic Anemia | 26. Bacterial Meningitis |

| 8. Benign Brain Tumor | 27. Deafness |

| 9. Encephalitis | 28. Amyotrophic Lateral Sclerosis (ALS) |

| 10. Progressive Bulbar Palsy (PBP) | 29. Meningeal Tuberculosis |

| 11. Celebral Metastasis | 30. Loss of Speech |

| 12. Coma | 31. Parkinson's Disease |

| 13. Terminal Illness | 32. Medullary Cystic Disease |

| 14. Alzheimer's Disease | 33. Fulminant Hepatitis |

| 15. Major Head Trauma | 34. End Stage Liver Failure |

| 16. Motor Neuron Disease | 35. Guillain-Barre Syndrome |

| 17. Major Organ Transplant | 36. Coronary Artery Bypass Surgery |

| 18. Surgery for Disease of the Aorta (Aortic Surgery) | 37. Lupus |

| 19. Replacement of Heart Valve |

Member benefits

Birthday Gift

Lifetime Membership

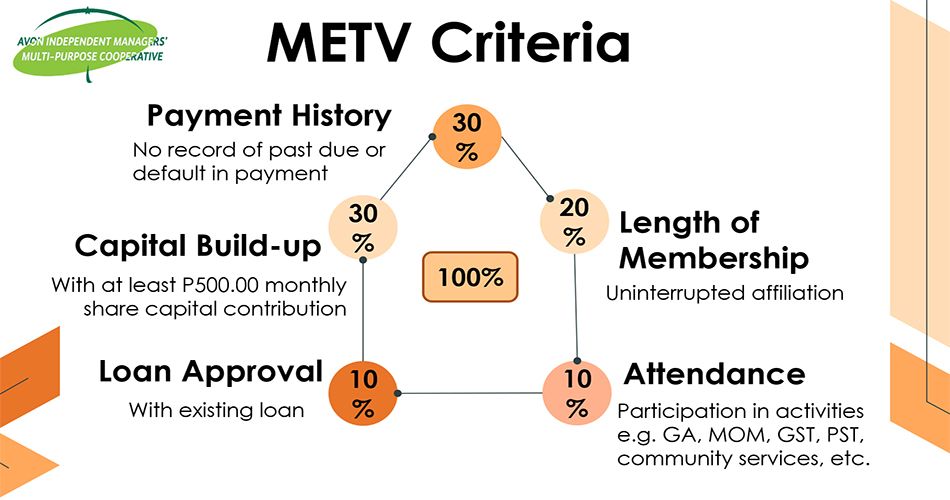

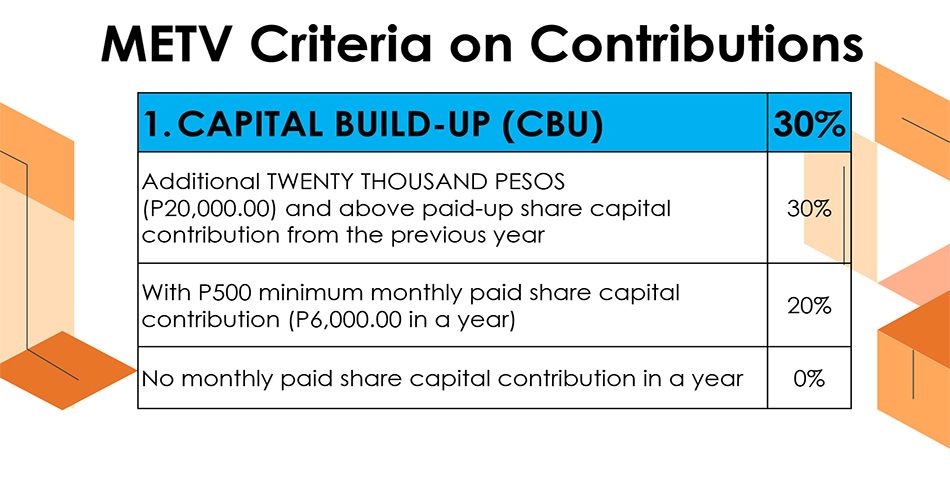

Criteria:

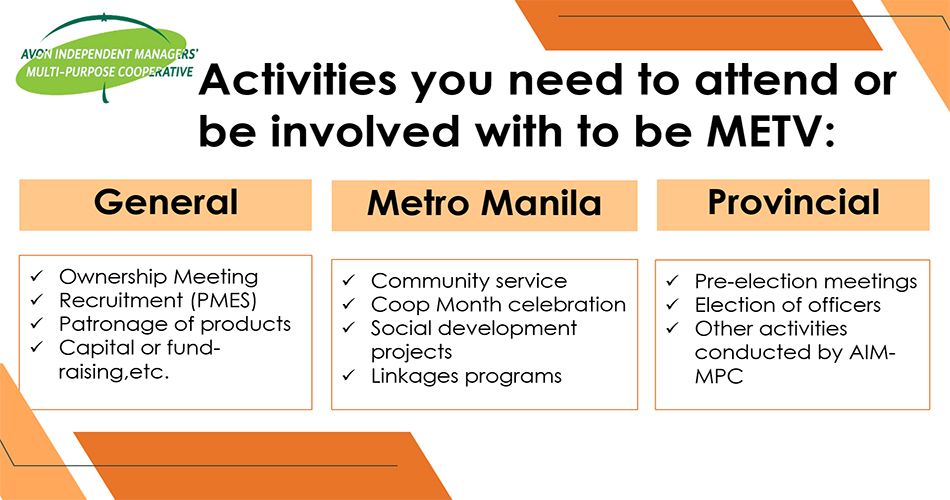

MUST be a member-entitled-to-vote (METV) during residency

benefits:

Learning Development:

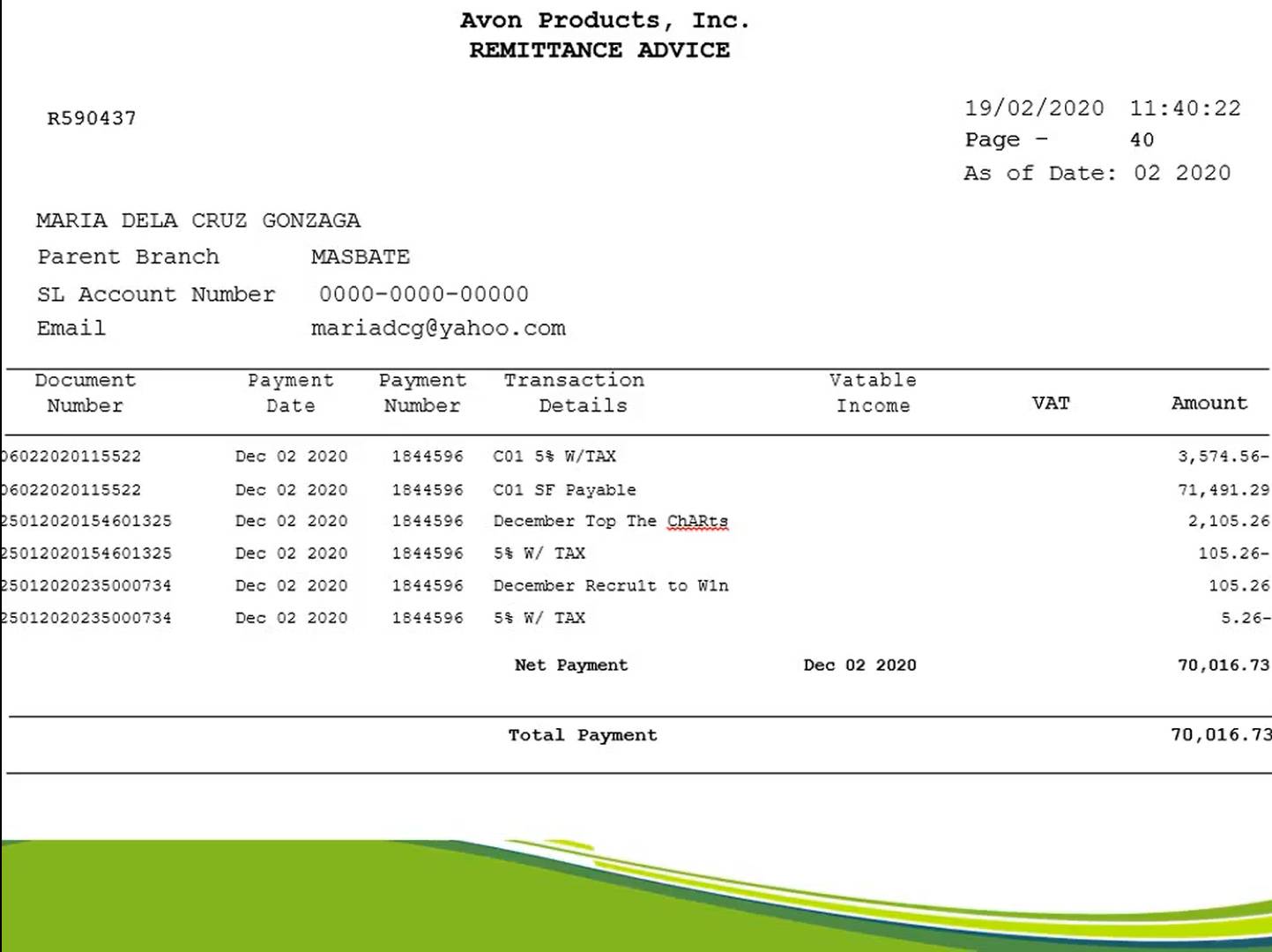

Dividends

Interest on Share Capital (ISC) and Patronage Refund (PR)

ALL MEMBERS shall receive DIVIDENDS thru

|

|

|

|

|

Distribution is done during the |

News

*** No Records ***

Gallery

30TH ANNUAL GENERAL ASSEMBLY MEETING

Dec 30, 2022 - 05:02:23 PM

29th Annual General Assembly Meeting

Dec 30, 2022 - 04:53:38 PM

BC Competency Assessment 2019

Dec 18, 2022 - 05:40:38 PM

5th ANNUAL OFFICERS` CONFERENCE

Dec 18, 2022 - 11:06:54 AM

Contact Us

Location:

Samat Place 884 Samat St., Brgy. Highway Hills, Mandaluyong City, 1550

Email:

aimmpc2016@gmail.com

Call:

| Landline: | Mobile: |

| 02 8535-7969 | 0908-8202614 |

| 02 8254-4201 | 0917-5178903 |

| 02 7771-7093 |

Business Hours:

Mon-Fri: 8:00AM - 5:00PM

Site Map

Downloadable Form

Attachment List

| File Name | No. of Download | |

| Activity Design - PMES MOM | Download | |

| ACTIVITY DESIGN for Committee | Download | |

| Attendance Sheet | Download | |

| ATTENDANCE SHEET - VIRTUAL | Download | |

| AUTHORITY TO DEDUCT FOR SFD | Download | |

| BC REPORT - METRO 2 pages | Download | |

| BC REPORT - PROV 2 pages | Download | |

| CHANGE OF MODE OF PAYMENT (MOP) | Download | |

| Co-Applicant Form | Download | |

| College Scholarship Form | Download | |

| DEDUCTION FROM SAVINGS DEPOSIT | Download | |

| DEED OF AFFIRMATION AND ACKNOWLEDGEMENT | Download | |

| Deposit increase request | Download | |

| Gadget Loan Form | Download | |

| LELL RTD | Download | |

| LETTER OF INTENT | Download | |

| LIQUIDATION FORM | Download | |

| MEMBERSHIP APPLICATION FORM FOR FAMILY MEMBERS | Download | |

| MEMBERSHIP APPLICATION FORM P1 | Download | |

| MEMBERSHIP APPLICATION FORM P2 | Download | |

| Membership Withdrawal | Download | |

| NLRP | Download | |

| PER DIEM REQUEST - FOR OFFICERS | Download | |

| SHARE SUBSCRIPTION | Download | |

| SLRP | Download | |

| TRAINER'S FIELD REPORT | Download | |

| TWILIGHT PROGRAM ENROLMENT FORM | Download |